High prices are luring Africans into prospecting for gold. But huge

volumes are smuggled out through the Middle East.

By DAVID LEWIS in Nairobi, RYAN McNEILL and ZANDI SHABALALA in London

Billions of dollars’ worth of gold is

being smuggled out of Africa every year through the United Arab Emirates in the

Middle East – a gateway to markets in Europe, the United States and beyond

– a Reuters analysis has found.

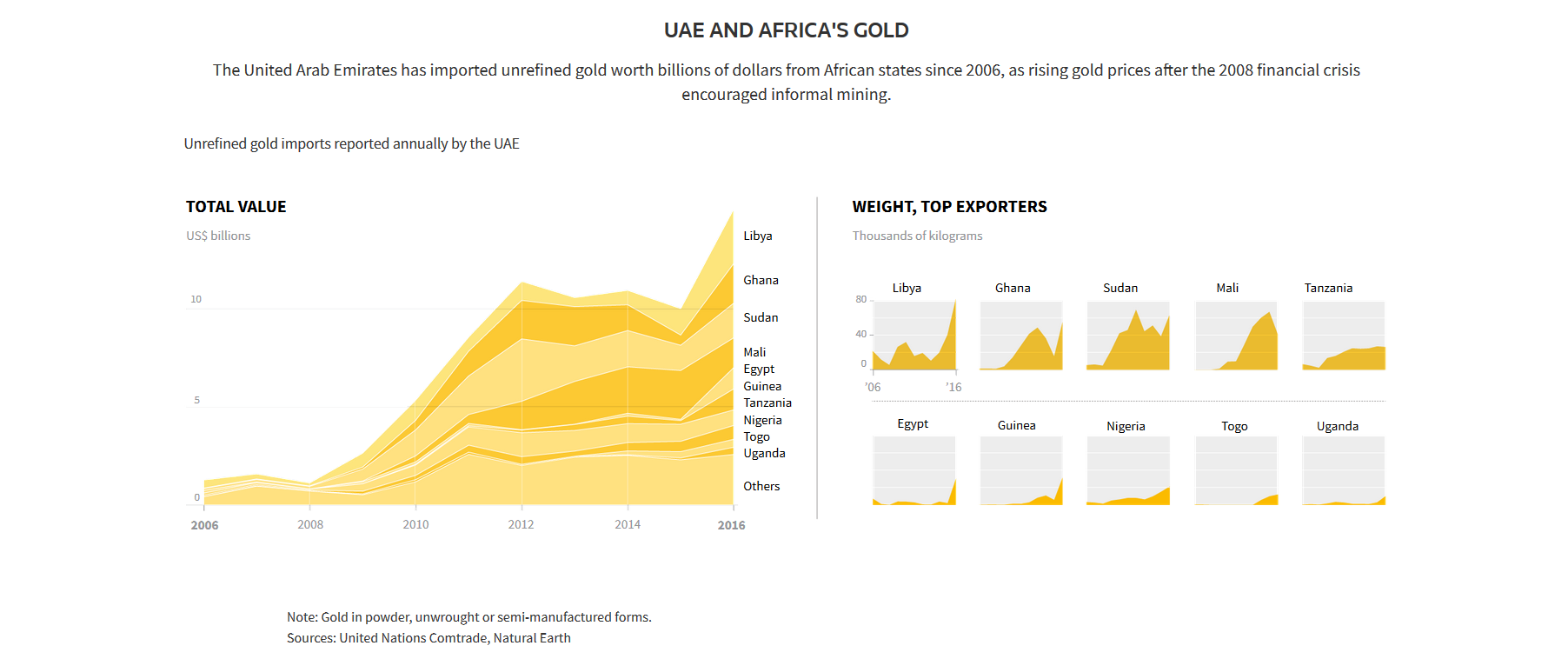

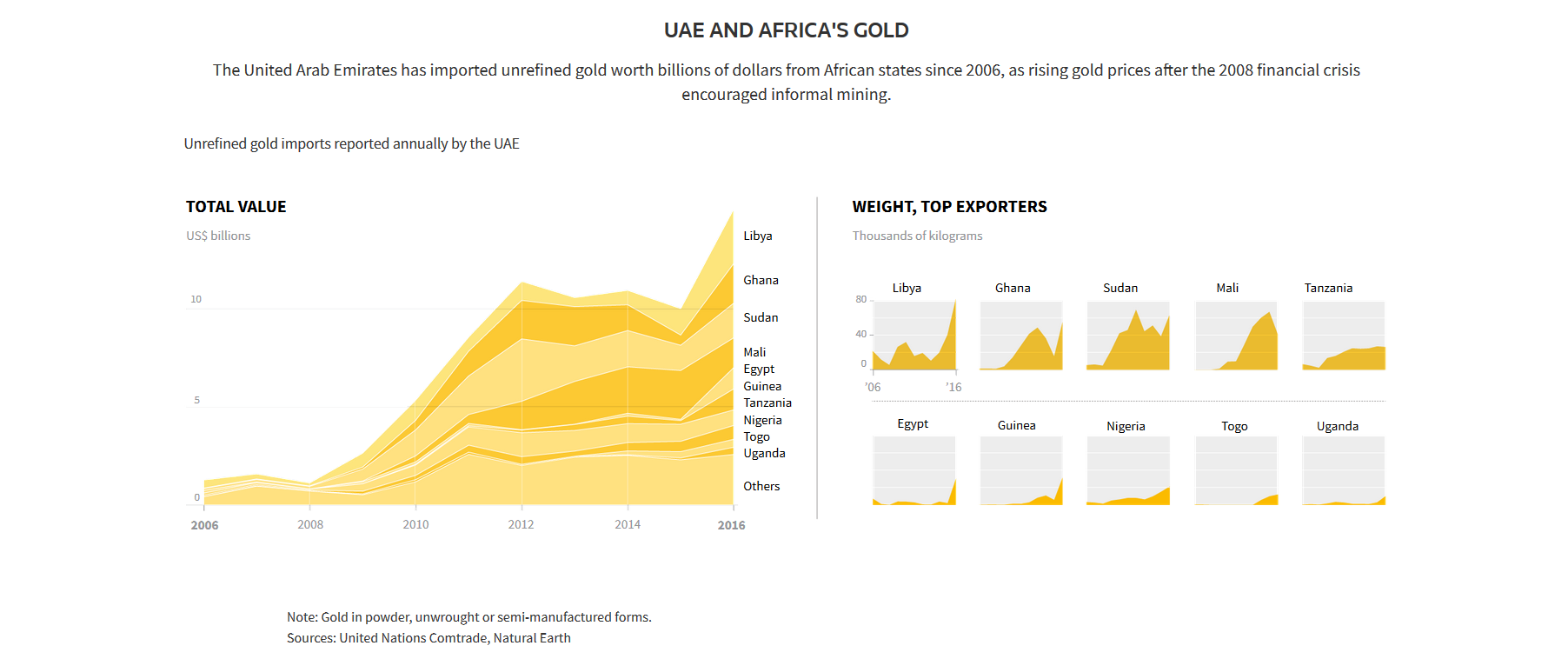

Customs data shows that the UAE imported

$15.1 billion worth of gold from Africa in 2016, more than any other country

and up from $1.3 billion in 2006. The total weight was 446 tonnes, in varying

degrees of purity – up from 67 tonnes in 2006.

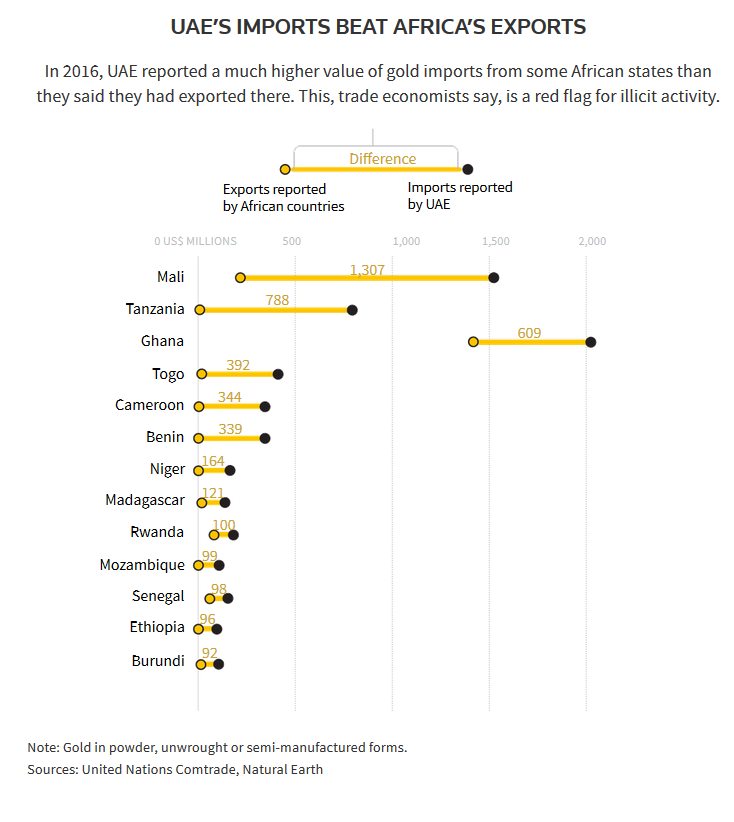

Much of the gold was not recorded in

the exports of African states. Five trade economists interviewed by Reuters

said this indicates large amounts of gold are leaving Africa with no taxes

being paid to the states that produce them.

Previous

reports and studies have highlighted the black-market trade in gold mined by

people, including children, who have no ties to big business, and dig or pan

for it with little official oversight. No-one can put an exact figure on the

total value that is leaving Africa. But the Reuters analysis gives an estimate

of the scale.

Reuters assessed the volume of the

illicit trade by comparing total imports into the UAE with the exports declared

by African states. Industrial mining firms in Africa told Reuters they did not

send their gold to the UAE – indicating that its gold imports from Africa come

from other, informal sources.

Informal methods of gold production,

known in the industry as “artisanal” or small-scale mining, are growing

globally. They have provided a livelihood to millions of Africans and help some

make more money than they could dream of from traditional trades. But the

methods leak chemicals into rocks, soil and rivers. And African

governments such as Ghana, Tanzania and Zambia complain that gold is now being

illegally produced and smuggled out of their countries on a vast scale,

sometimes by criminal operations, and often at a high human and environmental

cost.

Artisanal mining began as small-time

ventures. But the “romantic” era of individual mining has given way to

“large-scale and dangerous” operations run by foreign-controlled criminal

syndicates, Ghana’s President Nana Akufo-Addo told a mining conference in

February. Ghana is Africa’s second-largest gold producer.

Not everyone in the chain is breaking the law. Miners, some of them

working legally, typically sell the gold to middlemen. The middlemen either fly

the gold out directly or trade it across Africa’s porous borders, obscuring its

origins before couriers carry it out of the continent, often in hand luggage.

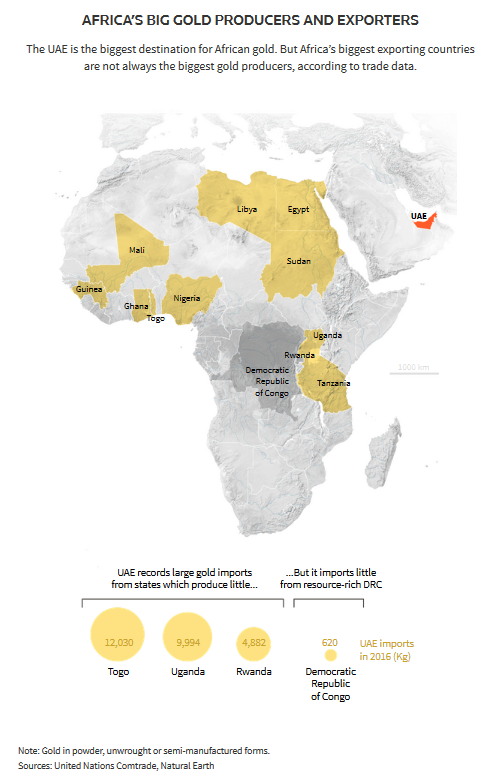

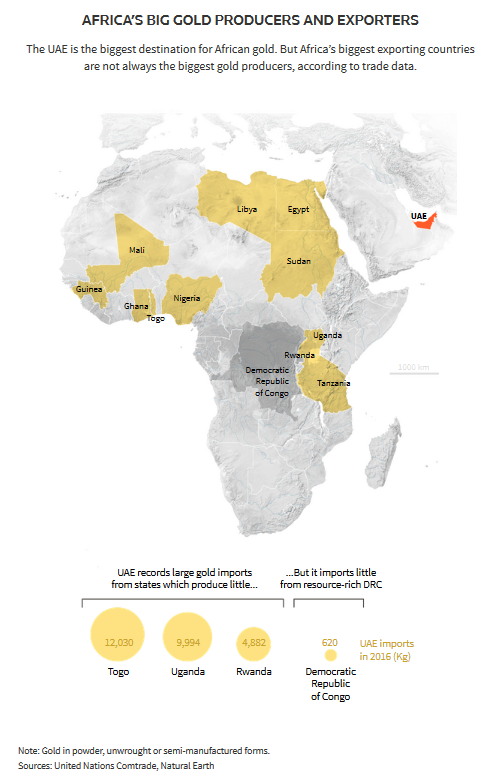

For example, Democratic Republic of Congo (DRC) is a major gold producer but

one whose official exports amount to a fraction of its estimated production:

Most is smuggled into neighbouring Uganda and Rwanda. “It is of course

worrisome for us but we have very little leverage to stop it,” said Thierry

Boliki, director of the CEEC, the Congolese government body that is meant to

register, value and tax high-value minerals like gold.

The customs data provided by governments to Comtrade, a United Nations

database, shows the UAE has been a prime destination for gold from many African

states for some years. In 2015, China – the world’s biggest gold consumer –

imported more gold from Africa than the UAE. But during 2016, the latest year

for which data is available, the UAE imported almost double the value taken by

China. With African gold imports worth $8.5 billion that year, China came a

distant second. Switzerland, the world’s gold refining hub, came third with

$7.5 billion worth.

Most of the gold is traded in Dubai, home to the UAE's gold industry.

The UAE reported gold imports from 46 African countries for 2016.

Of those countries, 25 did not provide Comtrade with data on their gold

exports to the UAE. But the UAE said it had imported a total of $7.4 billion

worth of gold from them.

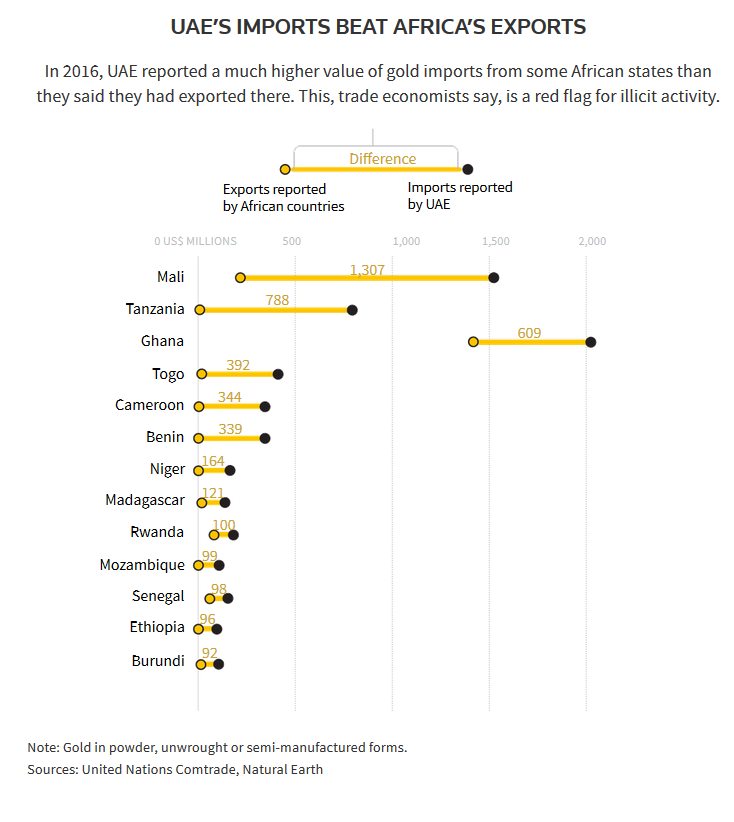

In addition, the UAE imported much more gold from most of the other 21

countries than those countries said they had exported. In all, it said it

imported gold worth $3.9 billion – about 67 tonnes – more than those

countries said they sent out.

“There is a lot of gold leaving Africa without being captured in our

records,” said Frank Mugyenyi, a senior adviser on industrial development at

the African Union who set up the organisation’s minerals unit. “UAE is cashing

in on the unregulated environment in Africa.”

The Dubai Customs Authority referred Reuters’ queries to the UAE foreign

ministry, which did not respond. The UAE government media office referred

Reuters to the UAE federal customs authority, which also did not respond.

Not all the discrepancies in the data analysed by Reuters necessarily

point to African-mined gold being smuggled out through the UAE. Small

differences could result from shipping costs and taxes being declared

differently, a time-lag between a cargo leaving and arriving, or simply

mistakes. And gold analysts say some of the trade, especially from Egypt and

Libya, could include gold that has been recycled.

But in 11 cases, the per-kilo value that the UAE declared importing is

significantly higher than that recorded by the exporting country. This, said

Leonce Ndikumana, an economist who has studied capital flows in Africa, is a

“classic case of export under-invoicing” to reduce taxes.

Matthew Salomon, an American economist who has researched the use of

trade statistics to identify illicit financial flows, said the issue deserves

scrutiny. “Persistent discrepancies in the trade of particular goods and

between particular countries … can identify significant risks of illicit

activity,” he said.

Pollution, conflict and bandits

Over the past decade, high demand for gold has made it attractive for

informal miners to use digging equipment and toxic chemicals to boost the

yield. Contaminated water is returned to rivers, slowly poisoning the people

who need the water to live.

Small-scale miners have long used mercury – easy to buy at around $10

for a thumb-sized vial – to extract flecks of gold from ore, before sluicing it

away. Mercury’s toxic effects include damage to kidneys, heart, liver, spleen

and lungs, and neurological disorders, such as tremors and muscle weakness.

Cyanide and nitric acid are also being used in the process, according to

researchers and miners in Ghana.

Industrial mining companies have also been responsible for pollution,

ranging from cyanide spills to respiratory problems linked to dust produced by

mining operations. But almost a dozen states including DRC, Uganda,

Chad, Niger, Ghana, Tanzania, Zimbabwe, Malawi, Burkina Faso, Mali and Sudan

have complained in the past year about the harms of unauthorised mining.

Burkina Faso has banned small-scale mining in some areas where al

Qaeda-linked Islamists are active, and earlier this month Nigeria’s government

suspended mining in the restive northwestern state of Zamfara, saying

intelligence reports established what it called “a strong and glaring nexus”

between the activities of armed bandits and illicit miners.

Strong prices have fuelled the boom. Today, gold trades at over $40,000

per kilo, which is below a peak from 2012 but still four times the level of two

decades ago.

Western investors want gold so they can diversify their portfolios;

India and China want it for jewellery. But most Western companies – and the

banks that finance them – avoid handling non-industrial African gold directly.

They are unwilling to risk using metal that may have been mined to fund

conflict or that may have involved human rights abuses in, for instance, DRC or

Sudan. Various Uganda-based traders have been sanctioned for handling gold

smuggled out of DRC.

Destination Dubai

In other states, including the UAE, these concerns have been less of a

problem. Over the last decade, gold from Africa has become increasingly

important for Dubai. From 2006 to 2016, the share of African gold in UAE’s

reported gold imports increased from 18 percent to nearly 50 percent, Comtrade

data showed.

The UAE’s main commodity marketplace, the Dubai Multi-Commodities Centre

(DMCC), calls itself on its website “your gateway to global trade.” Trading in

gold accounts for nearly one-fifth of UAE’s GDP.

However, no big industrial companies reached by Reuters – including

AngloGold Ashanti, Sibanye-Stillwater and Gold Fields – say they send gold

there. Reuters contacted 23 mining companies with African operations, the

smallest of which produced around 2.5 tonnes in 2018: 21 of them said they did

not send metal to Dubai for refining, the other two did not respond.

While the big South African miners have local refining capacity, the main

reason others gave is that no UAE refineries are accredited by the London

Bullion Market Association (LBMA), the standard-setter for the industry in

Western markets.

The LBMA is “not comfortable dealing with the region” because of

concerns about weaknesses in customs, cash transactions and hand-carried gold,

its chief technical officer Neil Harby told Reuters. Investigators and people

in the gold industry say the ease with which smugglers can carry gold in their

hand-luggage on planes leaving Africa helps gold flow out unrecorded. And

limited regulation in UAE means informally mined gold can be legally imported,

tax-free.

Gold can be imported to Dubai with little

documentation, African traders told Reuters.

A DMCC spokesman said it has a robust regulatory framework that includes

strict responsible sourcing rules. These are aligned with the international

benchmark for responsible sourcing laid out by the Organisation for Economic

Cooperation and Development (OECD).

Sanjeev Dutta, head of commodities at DMCC, said in January that the

centre is building strategic relationships with most gold-producing countries

on the African continent, “and we are very confident of how that production is

done and how responsible” it is. Over the past 12 months, he said, DMCC has

firmed up a standard for refineries, called Dubai Good Delivery, which he said

is very strict on responsible sourcing and sustainability. “We track right from

responsible sourcing to sustainable development, things like human rights

etc.,” he said. “We demand export certificates.”

A “very limited” number of refineries accept gold that has been imported

as hand luggage, Dutta said, but gave no figures.

Gold to go

Some African miners are swapping their pickaxes and shovels for diggers

and crushers – increasing production volumes exponentially. Regulation remains

scant, and accidents are frequent. In one week this February, three accidents

at illegal mining operations in Zimbabwe, Guinea and Liberia claimed the lives

of more than 100 people.

Often, miners must surrender a cut of their output, as commission, to

the people who control a pit, let out the equipment, or buy and sell the gold.

NGOs such as Global Witness and Human Rights Watch have documented child

labour, corruption and links to conflict at some of these mines. At one mine

in Zimbabwe visited by Reuters, people said they had to hand over some of their

find before they would even be allowed out of the pit.

Reuters presented its analysis to 14 African governments. Of them, five

said it reflected an existing concern about gold being smuggled out of their

countries that they are trying to address. One said they did not think gold

smuggling was a problem for them. The rest declined to comment or did not

respond.

Governments across Africa are trying to work out how to manage a sector

that, whatever its risks, provides a livelihood for many of their

citizens, and which could be harnessed as a source of revenues.

Some, including Ivory Coast, are taking gradual steps to regulate their

informal mining operations. Ghana and Zambia have sent security forces into

mining areas to halt operations so miners can be registered and regulations put

in place. Ghana, concerned that a rush of mainly Chinese-led ventures is

harming the environment, has arrested hundreds of Chinese miners and expelled

thousands in the past six years.

At the end of last month, Ghana temporarily

banned the import of excavator equipment to try to stem a surge in illegal

mining using heavy machinery.

“I understand that Dubai is the destination for this gold. But since

(the trade) is fraudulent, I have no details.”

Burkina

Faso Mines Minister Idani Oumarou

In Sudan, one of the continent’s biggest producers,

the government has unveiled a $3 billion plan for private banks to work with

the central bank to buy gold from small-scale miners, offering prices that

would make it less attractive to sell on the black market.

A Tanzanian parliamentary

report estimated that 90 percent of annual production of informally mined gold

is smuggled out of the country: The government wants the central bank to buy

this up. In March, President John Magufuli launched a plan to establish hubs

where the trade would be formalised by offering access to financing and

regulated markets.

In Burkina Faso, Oumarou Idani, minister of mines,

believes his country is leaking gold to UAE on a massive scale. Of the 9.5

tonnes of gold the government estimates informal miners dig up each year, just

200 to 400 kg are declared to the authorities, he said.

Much of the gold is smuggled from

landlocked Burkina Faso to its Atlantic coast neighbour Togo, according to the

minister. In Togo, virtually no taxes are imposed on gold.

Togo’s director of mining

development and controls, Nestor Kossi Adjehoun, said informal mining is “an

area that we have not properly figured out.” For now, he said, Togo saw no

reason to suspect gold was being smuggled through the country.

“I understand that Dubai is the

destination for this gold,” his Burkina Faso neighbour, Minister Idani, told

Reuters in an interview last year. “But since (the trade) is fraudulent, I have

no details.”

Additional reporting by John Ndiso

in Nairobi, Tim **s in Ouagadougou, Ed McAllister in Dakar, Chris Mfula in

Lusaka, Giulia Paravicini in Kinshasa, MacDonald Dzirutwe in Battlefields,

Zimbabwe, John Zodzi in Lome, Fumbuka Ng’wanakilala in Dodoma, Maha El Dahan in

Dubai, and Peter Hobson in London

New Gold

Rush

By David Lewis, Ryan McNeill and

Zandi Shabalaba

Data: Ryan McNeill

Graphics: Samuel Granados and

Michael Ovaska

Photo editing: Simon Newman

Video: Tim **s and Matt Larotonda

Design: Pete Hausler

Edited by Sara Ledwith, Alexandra

Zavis and Richard Woods