Horns of a Dilemma:

Mozambique poaching enriching North Korea's leadership

- Don Pinnock

- 12 Jul 2016 11:19 (South

Africa)

According to a study just released

by Global Initiative Against Transnational Organised Crime, the country is

incapable of disrupting the criminal syndicates that have turned it into a

major trans-shipment point for rhino horn, heroin, cocaine, methamphetamine and

dagga. The value of illegal drug trade in Mozambique, it claims, is probably

greater than all foreign aid combined.

Global Initiative rhino

investigator Julian Rademeyer found that the corruption permeating every level of the Mozambique state and the

country's leaky ports, airports and borders made it a smuggler's paradise. Of

great concern is what he describes as "dodgy diplomats”, particularly North

Koreans, using this weakness to smuggle illicit products.

Once hailed as a post-civil war

success story, Mozambique, he says, is a country in crisis, paralysed by

rampant corruption, a weak judiciary, an ineffectual and criminally compromised

police force, and powerful criminal syndicates with tentacles reaching into

every level of the state.

Many of Mozambique's political

elite, according to Global Initiative, have grown fat on the proceeds of the

patronage networks that grew and festered for a decade under the country's

former president, Armando Guebuza.

"His successor, Filipe Nyusi, is

still grappling with Guebuza's toxic legacy and, more than a year since he took

office, has yet to solidify control over the state and Frelimo, the ruling

party.”

Added to Mozambique's problems is

its role as a key regional money-laundering hub, a dramatic increase in

kidnappings-for-ransom and a series of high profile assassinations that, among

others, have claimed the lives of a judge, journalists and, most recently, a

prosecutor.

"There is a very real sense of

fear within the judiciary and government,” a diplomat based in Maputo told

Global Initiative. "People don't want to rock the boat because they could be

next.”

In May this year the country was

also rocked by revelations that the government had tried to conceal close to

$1.4-billion in hidden loans from donor countries and agencies. The

International Monetary Fund (IMF), the World Bank, the European Union (EU),

African Development Bank, and several other donors suspended aid "pending a

full disclosure and assessment of the facts”.

An IMF official said the concealment

"is probably one of the largest cases of the provision of inaccurate data by a

government the IMF has seen in an African country in recent times”. Mozambique

is heavily dependent on foreign aid.

Conservationists in South Africa

and Mozambique say they are encouraged by the work done by Mozambique's

National Agency for Conservation Areas, but are frustrated by the lack of

progress from the Mozambican police in apprehending key poaching and

trafficking ringleaders.

"Policing is abysmal,” said a

Mozambican conservationist. "There's enough evidence to arrest and prosecute.

We know who the key figures are. They are very well known. Despite that, we are

not able to arrest any of the poaching gang leaders.”

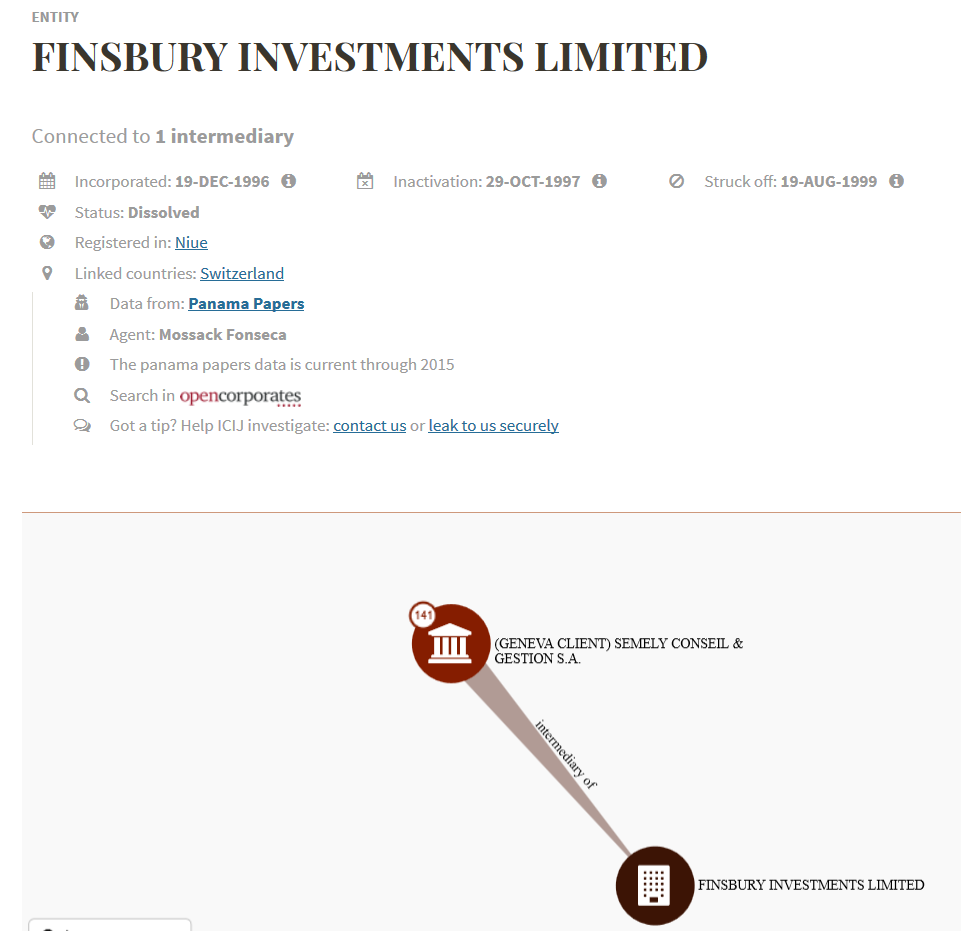

The Global Initiative report

highlights the increasing role and impunity of North Korean diplomats in

criminal activities in the southern African region. An example was the arrest,

in Maputo in May 2015, of a North Korean diplomat and a Taekwon-Do instructor

after 4.5kg of rhino horn and $100,000 was found in their vehicle. Police

detained them and impounded the vehicle.

Within hours of learning of the

incident, the North Korean ambassador to South Africa, Yong Man-ho, was on a

flight from Johannesburg to Maputo. The diplomats were released after paying $30,000

and the vehicle was returned to them.

Diplomatic and government sources

in South Africa have made similar claims, telling Global Initiative that the

North Korean embassy in Pretoria is "actively involved in smuggling ivory and

rhino horn” and may be linked to other illegal activities.

There are also allegations that

the North Korean embassy in Addis Ababa is being used as a transit point for

the smuggling of illicit wildlife products to China, with embassy officials

abusing their diplomatic status to act as couriers.

Since the mid-1970s, North Korea's

involvement in transnational organised crime - particularly drug and cigarette

trafficking, weapons smuggling and the production of counterfeit US currency -

has grown steadily, peaking during the severe economic crisis and famine the

country faced in the early and mid-1990s.

North Korean embassy officials

have been implicated in 16 of the 29 smuggling cases involving diplomats that

Global Initiative identified in a variety of sources dating from 1986.

A 2007 assessment of illicit

activity and smuggling networks concluded that "North Korea possesses

sophisticated smuggling capabilities developed from years of transnational

criminal activity, driven by economic necessity and justified with ideological

veneer”. These illicit activities are said to be controlled by a shadowy agency

known as Division 39.

The US described it as "a

secretive branch of the government... that provides critical support to [the]

North Korean leadership, in part through engaging in illicit economic

activities, managing slush funds and generating revenues for the leadership”.

In this North Korea's embassies appear to play a key role.

From the mid-1960 to the late

1990s, according to Global Initiative, Pyongyang poured military and financial

resources into Africa, hoping to sway newly independent countries to recognise

the North Korean leadership. Embassies were established across the continent

but quickly became a financial burden.

After the country defaulted on its

international debts in 1975, its embassies were required to "self-fund” their

operations, a practice that continues to this day. "Diplomats are expected to

earn enough money to supplement their paltry salaries and be able to make

sizeable financial contributions to the central government in Pyongyang.” Some

embassies even use their vehicles as a private taxi service.

According to Rademeyer, the need

to self-fund is part of the reason Korean diplomats have been implicated in

crimes ranging from diamond, gold, drug and gun smuggling to trafficking in

counterfeit currency, cigarettes, medicines and electronics.

With seeming immunity from

prosecution by African states, supporting organised crime seems to have become

one of the primary preoccupations of North Korea's beleaguered embassies.

With most of the planet's rhinos

in Kruger Park, which borders on Mozambique, the future of the species remains

extremely tenuous unless South Africa and the world takes action to hold Maputo

and North Korea to account.

Crimes that unhappen

When police stormed a house in

Matola on the outskirts of the Mozambican capital, Maputo, on 12 May 2015,

little did they expect to make the largest seizure of ivory and rhino horn in

the country's history.

Packed into shipping crates and

piled on the floor were 340 elephant tusks and 65 rhino horns. Together they

weighed about 1.3 tonnes, representing the deaths of at least 170 elephants and

more than 30 rhinos at the hands of poachers.

Fresh blood spatter and the rank

smell of decay indicated that some of the horns were from recent kills. One of

the occupants of the house, a Chinese national, was taken into custody. A day

later, a second Chinese man was arrested when he offered police investigators a

$34,000 bribe to drop the case.

TRAFFIC, the wildlife trade

monitoring network, praised the "highly significant seizure” and said it hoped

the arrests would signal "a new chapter in Mozambique's history of wildlife

trade law enforcement”. Tom Milliken, TRAFFIC's rhino and elephant programme

leader, said it was "now absolutely vital for a full and thorough investigation

to be carried out”, adding that "the opportunity must not be squandered”.

But it was squandered. A dozen

horns vanished within days of the raid, despite being under guard at the

police's provincial command headquarters. They were replaced with crude

replicas made from "bull horns”, according to some reports. The Chinese

suspects were released on bail after promising to return to court in November.

They disappeared without trace. DM

Photo: A

file picture dated 19 February 2016 and made available by the official North

Korean newspaper Rodong Sinmun via Yonhap News Agency (YNA), shows North Korean

leader Kim Jong-un speaking during a commendation ceremony for the scientists,

technicians, workers and officials who contributed to the recent successful

launch of a satellite, in Pyongyang, North Korea. EPA/RODONG SINMUN

Read More: http://www.dailymaverick.co.za/article/2016-07-12-horns-of-a-dilemma-mozambique-poaching-enriching-north-koreas-leadership/#.V4X1s6KmrZ0

Ministry of Health

Registry Clerk of Lukulu District in Western Province has been convicted to

five years imprisonment with hard labour for money laundering involving over

K73, 000.

Ministry of Health

Registry Clerk of Lukulu District in Western Province has been convicted to

five years imprisonment with hard labour for money laundering involving over

K73, 000.