Following Guptas' Temple

Money-Laundering Trail

A temple under construction in their home town of

Saharanpur was allegedly used in Gupta money-laundering schemes.

Jean le

Roux News 24

A R200-million temple, built in honour of the Gupta brothers' late father,

Shiv, was erected in their home town of Saharanpur using money laundered

through several of the Gupta brothers' Indian and Dubai companies.

In March this year, Indian revenue authorities raided several of the Gupta

brothers' properties on charges of money laundering and tax evasion.

The temple was among these properties.

Despite the Guptas themselves footing the bill for the construction of the

temple, a local Indian politician, Mansoor Badar, and Sanjay Grover, a known

Gupta lieutenant in Dubai, were used as the "donors" of the money

earmarked for the temple's construction.

In this multi-part investigation, we consider how the Gupta family laundered

money using companies set up in Dubai and India, freeing them up to fund the

temple's construction.

First stop: Saharanpur

Construction started on the Shiva Dham

temple, located in the northern outskirts of the Gupta brothers' hometown of

Saharanpur, in June 2014. The temple complex consists of several buildings,

including the main temple itself, and a hall designed by architectural firm

Trivedi Corporation in India.

The temple was still under construction in January this year.

And while documents in the Gupta leaks claim that Badar and Grover are the sole

funders of the temple's construction, at least a portion of the donations was

bankrolled by the Guptas themselves, making fools of Indian revenue authorities

in the process.

To get the money into India, the Guptas needed a plan. The Gupta leaks show that

Tony Gupta expressed an interest in establishing the family's own religious

trust early in 2014. The Guptas also discussed ways of transferring money out

of the country with their auditors at the time, KPMG.

"We also note there is a desire to investigate the feasibility of transferring

funds offshore, especially to India, to be utilised as religious donations (as

part of funding to build the temple in the vicinity of your home town in India)

as well as for business purposes," wrote Muhammad Saloojee, director and

head of corporate tax at KPMG, on June 30, 2014.

Between June 2014 and December 2014, the family appeared to have abandoned

establishing their own trust and focused on using an existing religious trust

instead. The Gupta leaks show that the temple's construction was overseen and

paid for by an entity called Sh Siv Mandir Gor Sankar Vishwana Banunth Dham and

Samsa Bumi Prabndak Saba (the Siv Mandir trust), a religious trust founded in

1990. The Siv Mandir trust was responsible for paying service providers and

labourers for the construction of the temple.

The reasoning behind using a trust was economic: in terms of Indian tax

laws, a religious trust can apply for favourable treatment of its own income as

well as any donations made by its funders.

On December 10, 2014, Atul and Tony Gupta drafted a letter on behalf of

their mother, the Gupta matriarch Angoori Gupta. The letter begged the Indian

revenue authorities to grant the Siv Mandir trust exemptions from certain tax

regimes.

Atul Gupta and his mother Angoori at the laying of the temple foundation

stone. (www.shivadham.in)

"This temple is being constructed at the total project cost of [about

R180-million]; the donation for which will be contributed by all individual

persons in Saharanpur – and [a] major portion of this donation will come from

Smt Angoori Devi Gupta and her family members and friends from all over the

world.

"Trust has also applied for Income Tax Exemptions u/s 12 A of [Income]

Tax Act and will also apply for exemption u/s 80 G of Income Tax Act. Once

these exemptions are granted by the appropriate authority's [sic] donation

[sic] from all across the world will start flowing in."

The letter was addressed to the tourism minister in Uttar Pradesh, the

province of the Guptas' hometown of Saharanpur, appealing to the minister to

intervene with the tax authorities.

The letter makes it clear that the Guptas intended funding the construction

of the temple using donations from their "friends and family".

With a tax-efficient and opaque trust set up to receive its donations, the

Guptas could begin funding it.

Funnelling the funds

The Gupta leaks show that the temple had two intended sources of income. The

first funder was Badar, a municipal councillor in Saharanpur. Badar was

earmarked to provide 23-million rupees [~R4.3-million] towards the construction

of the temple.

As part of the donation, Badar was required to submit a letter containing

very specific wording to the revenue authorities. The accountant for the

family's businesses in India, Ashok Khandelwal, drafted an example of the

letter to be used.

Khandelwal initially denied any role in the funding of the temple

construction.

"Without going into the merits of your allegations, we have absolutely

nothing to do with the so-called temple construction with which you are trying

to associate our name," he wrote in an email.

"We would have no problems if you were publishing the truth, but

publishing false stories without any facts should not be done. If you have any

evidence, of our involvement in this, kindly share the details of the same with

us before publishing the story in order for us to respond, because your

inference of the information, if any, that you have seems to be absolutely

wrong."

Khandelwal failed to respond when confronted with a copy of the donation

letter he drafted. He also failed to clarify why he drafted the letter under

instructions from Gupta family associates if the donor was Badar, an apparently

unrelated party. Instead, Khandelwal threatened legal action on the basis of

defamation and blackmail in response to the questions posed.

Badar's motivation appears to have been political. In December 2014, Gupta

lieutenant Ashu Chawla received two letters introducing Badar to the leader of

a local political organisation. The letters, which had to be translated,

introduce Badar to the leader of the Samajwadi Party, Akhilesh Yadav, and

propose Badar as an ideal candidate for the elections to be held the following

year.

Both Yadav and Badar also attended the Gupta family's infamous Waterkloof

wedding in 2013. Attempts to reach either Yadav or Badar for comment have been

met with no response.

But Badar was not about to use his own money to fund the temple, and this is

where the laundromat kicked in. The Gupta leaks indicate how it worked.

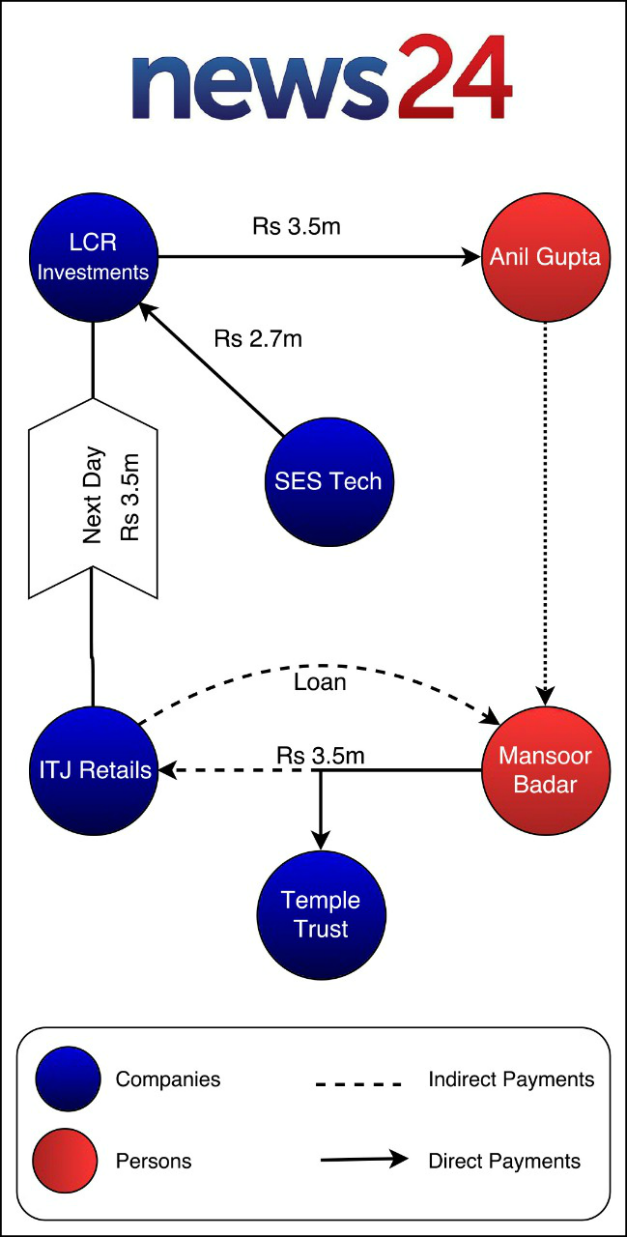

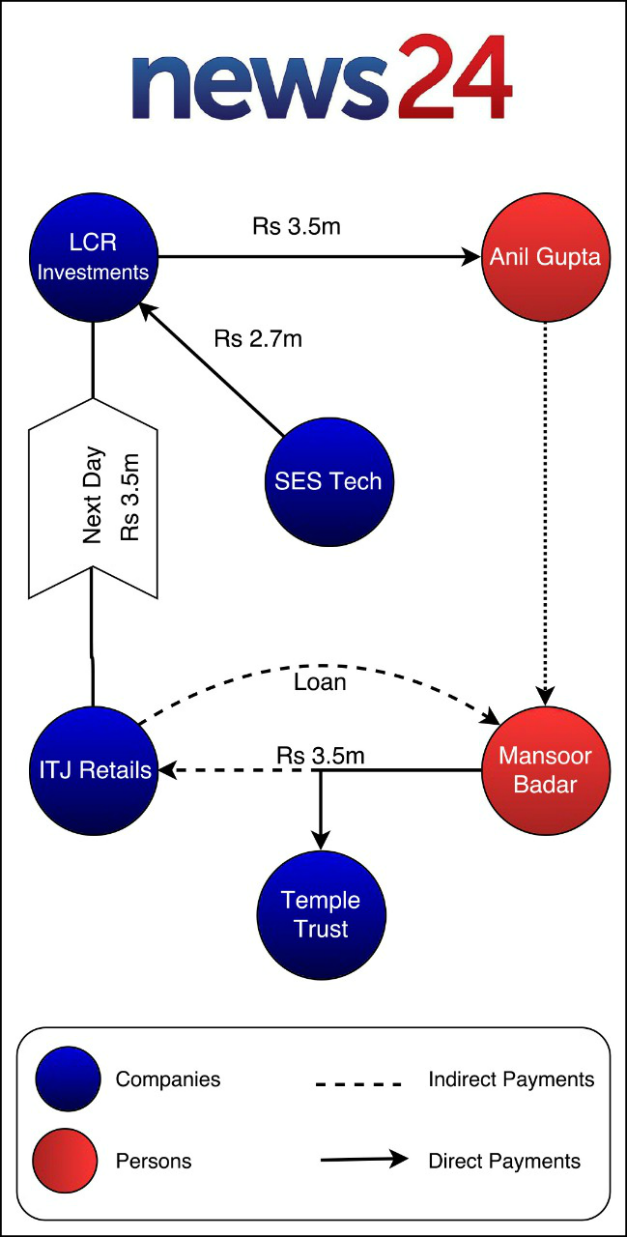

The laundering cycle used to fund Mansoor Badar's donations to the

temple trust. (Graphic: Jean le Roux and Jaco Grobbelaar)

Using several back-to-back payments, the true source of the funding would be

hidden behind several layers of transactions. All of these companies are either

under the direct control of Gupta family members, or their close associates.

The next day the cycle is repeated. ITJ Retails pays LCR Investments, who in

turn pays Anil Gupta. Anil Gupta arranges for the funds to be transferred by

unknown means to Badar, who in turn pays ITJ Retails.

This cycle was repeated for several days until about 21-million rupees

[~R3.9-million] was paid to ITJ Retails by Badar.

But the trick lies herein: Badar never paid ITJ Retails. By skipping the

last link in the chain, Badar would in effect "borrow" the money from

ITJ Retails by not paying it over. This was confirmed by the balance sheet for

ITJ Retails, which showed that as at March 4, 2014, Badar was owed exactly 23-million

rupees [~R4.3-million] – the same amount contained in the planned budget for

the temple.

The modus operandi becomes even clearer in another string of transactions or

journal entries ordered a year later.

On March 6, 2015, another Gupta lieutenant Suresh Tuteja again requested that

several payments be reflected, either as transactions or journal entries in the

books of the affected entities. Among these payments was 17.6-million rupees

[~R3.3-million] that Akash Khandelwal, the accountant-on-call for the Guptas,

was to receive from "Sanjay ji". This presumably referred to Sanjay

Grover, the former Gupta associate in Dubai.

This amount would then be transferred to ITJ Retails, who would in turn

"repay" Badar the 23-million rupees he lent ITJ Retails. Badar would

then make a 23-million-rupee payment to the "temple".

Akash Khandelwal denied that he received or made any such payments, but

would not explain why these payment instructions would be made using his name

as the recipient of the money to be paid to ITJ Retails.

The entries also showed that the "temple" would in turn be used to

settle a vehicle loan for the benefit of SES Technologies, another Gupta-linked

company that will feature prominently in the next instalment.

We can now trace a trail from the temple trust to Badar and eventually LCR

Investments and SES Technologies.

Going global

The source of the money received from LCR Investments and SES is a bit

murkier. But the Gupta leaks show how these companies were used to launder

money paid from several overseas sources.

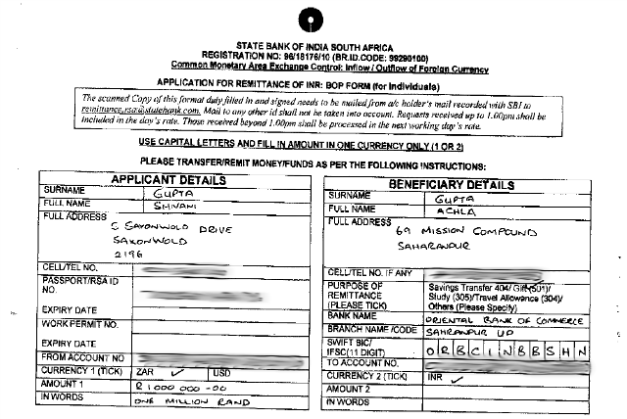

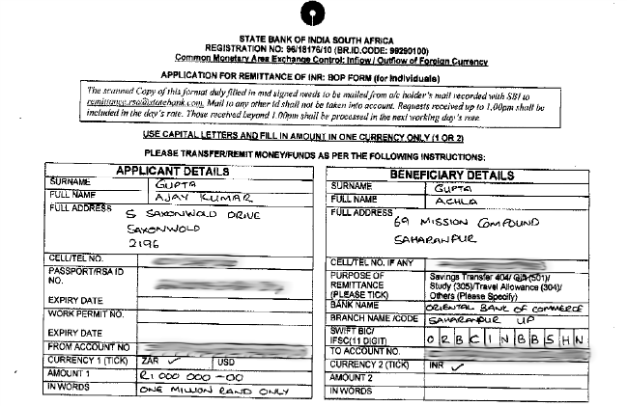

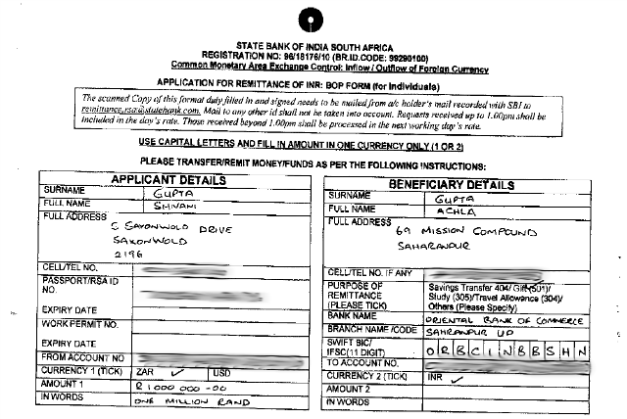

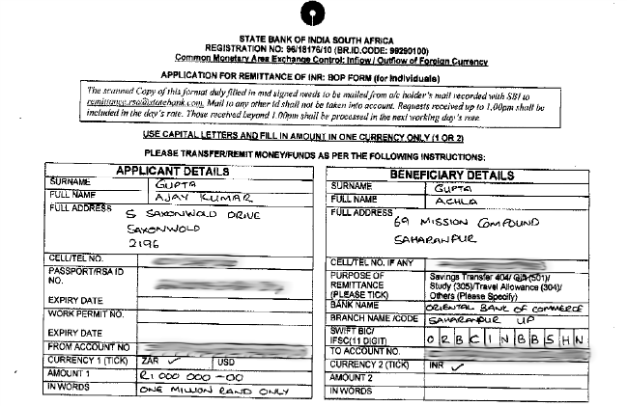

The first of these sources were donations paid by the Gupta family from

South Africa. In late 2013, Rajesh Gupta, his wife Aarti, and Atul's wife,

Shivani, each gifted R1-million to their sister in India, Achlia.

Achlia Gupta is the sister of brothers Ajay, Atul and Rajesh, and is married

to the same Anil Gupta mentioned above who provided Badar with the money to pay

ITJ Retails. The donations made in late 2014 appear to have been made directly

into Achlia's account.

The donations made to Achlia would invariably find their way back into the

LCR Investments' and SES Technologies' laundry cycle. Bank records for SES show

that Achlia frequently made large deposits into its account, which were

subsequently funnelled away. Achlia and other members of the Gupta family,

frequently made large unsecured loans to Gupta-linked companies, among them LCR

Investments.

Payments made to LCR Investments by Gupta-owned companies in Dubai were a

second source of foreign income. In 2014, Indian tax authorities queried the

source of funds used to provide several unsecured loans provided by the family

and its companies to LCR Investments during the previous financial year.

Anil, Achlia and Doon Leisure and Hospitality (an Indian company owned by

the Guptas, previously known as Sahara Computers and Electronics) were queried

in this matter.

In response, Achlia referred to a donation made to her by Shivani "out

of her natural love and affection for me and the same has been accepted by

me".

Yet this heart-warming gesture of charity was not paid directly to Achlia.

Instead, the money was paid from her sister's Bank of Baroda account into that

of the Dubai-based Global Corporation LLC. Global Corporation would in turn pay

this into the bank account of LCR Investments, again funding the cycle.

Global Corporation was one several Gupta-linked shelf companies that a

News24 investigation last year was unable to track down, despite journalists

spending a week in Dubai.

A third source of funds was direct payments from the Guptas' Dubai-based

companies. An elaborate example of the way the money is laundered is found in

the Gupta leaks, and involves several companies that the Guptas have direct

control over.

This laundering process will be delved into in the next instalment, as well

as its links to the family's Dubai operations.

Since submitting our enquiries to the affected parties, the temple's website

has been taken down. Archived versions of the website can be found here and here.

- News24

Pope Francis defrocks nine Ukraine monks amid claims they...

Pope Francis defrocks nine Ukraine monks amid claims they... 'The truth will be revealed': Pediatric nurse rents three...

'The truth will be revealed': Pediatric nurse rents three... Losing our religion: Christianity in Europe is dying out as...

Losing our religion: Christianity in Europe is dying out as...