N$18m stolen from SME Bank paid to Mugabe’s pilot

By and Timo Shihepo and Timo Shihepo |The Namibian| 19 August 2024

By and Timo Shihepo and Timo Shihepo |The Namibian| 19 August 2024

A total of N$18,8 million stolen from SME Bank was transferred to and laundered by former Zimbabwean president Robert Mugabe’s pilot and confidant Robert Mhlanga.

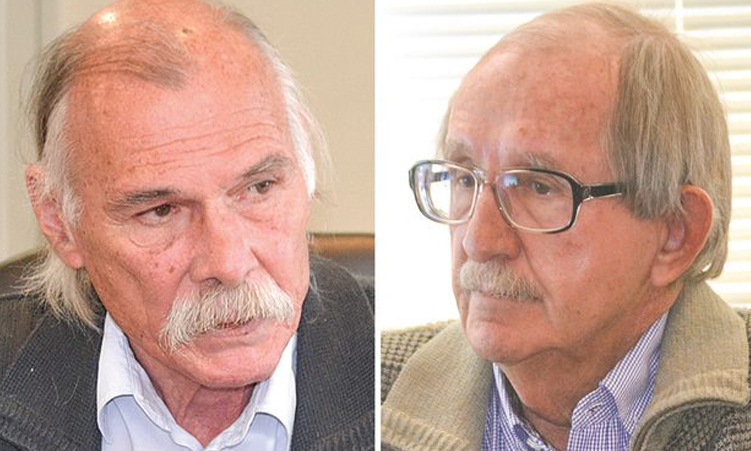

This is according to court documents filed in South Africa’s Gauteng High Court by SME Bank’s liquidators Ian McLaren and David Bruni.

The liquidators said approximately N$20,8 million was transferred from SME Bank into the trust account of a Johannesburg law firm called Paul Casasola & Associates between 2014 and 2015.

The law firm is owned by Mhlanga’s then lawyer Paul Casasola, who kept N$2 million of the stolen funds.

“The balance of N$18,8 million was remitted to Mhlanga and/or the Liparm Entities and/or third parties (for the benefit of Mhlanga and/or the Liparm Entities) by Casasola as paymaster from the Casasola & Associates’ Trust Account on the instruction of Mhlanga and/or the Liparm Entities,” the liquidators said.

The Namibian has learnt that Mhlanga quickly settled with Namibian liquidators when they pursued him in South Africa.

Though he repaid the N$18,8 million, this case provided further insight into how politically connected individuals exploited a bank meant to support small businesses in Namibia.

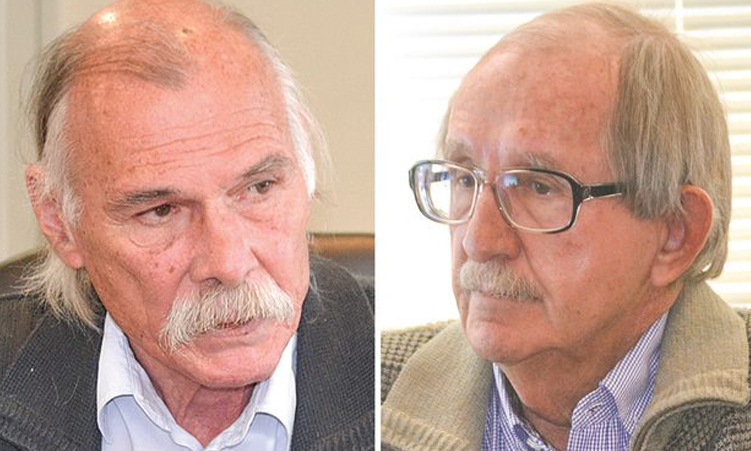

Enock Kamushinda

Enock Kamushinda

Zimbabwean Enock Kamushinda, who was Mugabe’s former personal banker, is accused of being the mastermind behind the bank heist. Kamushinda ran the SME Bank when funds were transferred to Mhlanga.

Mhlanga’s ex-lawyer Casasola yesterday said no funds were transferred from SME Bank into their trust account.

They denied wrongdoing.

Mhlanga has been a person of interest in South Africa.

South Africa’s AmaBhungane Centre for Investigative Journalism reported in 2012 that Mhlanga, a retired air vice-marshall, was widely regarded as a close associate of Mugabe and a business representative of the Mugabe family.

“Mega-rich Zimbabwean businessman Robert Mhlanga stands at the centre of an opaque network of companies set up to cash in on the Marange diamond fields with the help of the Zimbabwe government,” Mail and Guardian reported.

AmaBhungane also reported that Mhlanga has been on a N$185-million property buying spree in South Africa’s prime areas such as Durban’s coast and Sandton in Johannesburg.

THE WASHING MACHINE

The liquidators presented a case in the Johannesburg court, demonstrating how the N$20 million paid to Mhlanga and Paul Casasola was a result of fraud and money laundering.

Some of the payments to Mhlanga were labelled ‘Goldkid’.

According to the liquidators, the first sum stolen from SME Bank was N$2 million, transferred on 1 August 2014 in seven smaller transactions to avoid detection by Namibian authorities.

The amounts ranged from N$245 000 to N$355 000 and were made as cash deposits.

These stolen funds were initially paid to a company called Transparency Business Solutions, laundered through Rustic Stone Trading, and then transferred into the Casasola and Associates Trust Account.

Additionally, a N$2,5-million electronic payment was allegedly laundered from SME Bank on 29 August 2014, followed by another N$3 million on 22 September.

These funds were routed through entities such as Technical Assignments (Pty) Ltd, Benoni Brokers CC, Transparency Business Solutions and Rustic Stone Trading, before ending up in the Casasola and Associates Trust Account.

This laundering process continued on multiple occasions until 19 November 2015, by which time at least N$20 million had been stolen from SME Bank.

The liquidators stated that SME Bank was the rightful owner of the stolen money, which was laundered through various entities acting as conduits before being transferred to the Casasola and Associates Trust Account.

“The defendants (Mhlanga and Casasola) received the money in a reckless manner, knowing that the money was not due to them,” the liquidators said.

“. . . As a result of Casasola’s wrongful and unlawful, as well as intentional or reckless and negligent conduct, SME Bank suffered liquidated damages of N$20 million.”

The liquidators added “the business of the Liparm Entitles was carried on recklessly by Mhlanga with the intent to defraud creditors and SME Bank for a fraudulent purpose.”

Ian McLaren and David Bruni

Ian McLaren and David Bruni

‘IT WASN’T ME’

According to court documents, Paul Casasola & Associates claim they didn’t know where the money came from, but they knew they received it on behalf of Mhlanga and his company, Liparm.

In February 2021, Casasola said they received the money on behalf of Mhlanga and Liparm Entities.

At the same enquiry, Mhlanga testified that “Casasola has over a period of time received hundreds of millions of rands on his behalf and would make payments to third parties on Mhlanga’s instruction”.

McLaren and Bruni said Casasola and Paul Cassasola & Associates failed to establish the identity of the person(s) from whom the monies were received.

They said this was in breach of South Africa’s Financial Intelligence Centre Act (Fica).

They said the lawyer and his law firm did not terminate the business relationship between them and Mhlanga.

“The agreement, arrangement or transaction had the effect of concealing or disguising the nature, source, location, disposition or movement of the money or enabling or assisting Mhlanga or Liparm Entities to remove or diminish the money that was acquired as a result of the commission of the theft and fraud on the SME Bank,” the liquidators said.

CASASOLA RESPONDS

Casasola yesterday told The Namibian they were not aware that the money was stolen from Namibia.

“Our offices were not aware, nor could have been reasonably aware or suspected that any of the funds transferred into our trust account originally emanated from SME Bank as payments were effected from South African banks in furtherance of commercial transactions,” he said.

The Namibian asked Casasola if the firm was aware of the possibility that the funds they were handling were the proceeds of criminal activity.

Casasola said he could not comment on the matter, since it is confidential.

“… save to reiterate that no funds were transferred from SME Bank to our trust account and the action instituted by the liquidators of SME Bank referred to in your electronic mail under reply was settled to the satisfaction of all parties,” he said.

The payments to Mhlanga, then the chairperson of a diamond company in Dubai, were made around the same time that Namib Desert Diamonds (Namdia) was secretly formed under president Hage Geingob’s Presidency and then mines minister Obeth Kandjoze.

The Namibian reported around that time that Namdia diamonds were sold for peanuts to Dubai.

Tania Hangula

Tania Hangula

Later on, it emerged that Tania Hangula, the former chairperson of Namdia, used to frequently fly to Dubai courtesy of SME Bank’s millions.

SME Bank also spent more than N$2 million on hotel accommodation and flights to fly Hangula around the globe between 2016 and 2017.

Most of the money was spent on fligts to Dubai.

At the time, Mhlanga was the chairperson of Mbada Diamonds and was appointed as a director of the Dubai Diamond Exchange.

The Namibian understands that authorities have looked at the link between Mhlanga’s SME Bank payments and Hangula’s trip to Dubai.

The Supreme Court of Namibia this year referred the looting of over N$247 million from SME Bank to the prosecutor general for further investigation.

“Quite how this systematic looting of a registered bank was able to proceed over such a sustained period raises questions concerning the efficacy of the regulation and supervision of SME Bank by [the Bank of Namibia],” judge Dave Smuts said.