ARINSA news

ARINSA NEWS

Former TETA CEO sentenced to 7 years for role in Fidentia scandal

by Moonstone Information Refinery | 15 October 2024 |Moonstone

The former chief executive of the Transport Education and Training Authority (TETA), Pieter Hendrick Bothma, was this week sentenced to an effective seven years in prison for fraud, corruption, and money laundering related to the Fidentia scandal.

Charges against the 64-year-old stem from the investment of more than R200 million of TETA’s funds with Fidentia Asset Management (Pty) Ltd (FAM) between 2003 and 2005. On request, only R15m was returned to TETA in September 2003, the National Prosecuting Authority (NPA) said in a statement on Monday. Read more...

_________________________________

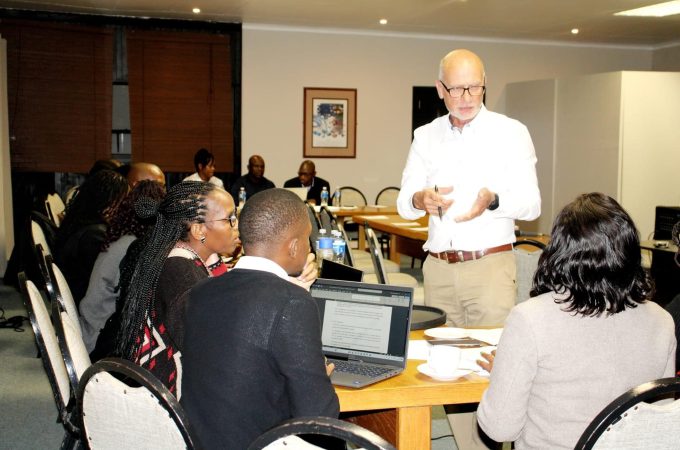

Prosecutors Review Standard Operating Procedures on Money Laundering

By Eljay | 24 September 2024 | News on Africa

By Eljay | 24 September 2024 | News on AfricaMbabane, Eswatini – Today, senior prosecutors from the Directorate of Public Prosecutions convened to assess and enhance the Standard Operating Procedures (SOPs) on money laundering. The review comes as part of ongoing efforts to strengthen Eswatini’s legal framework and ensure more effective prosecutions in financial crime cases.

The discussion, facilitated with guidance from the United Nations Office on Drugs and Crime (UNODC), focused on fostering investigative mindsets, identifying critical points to prove in money laundering cases, and addressing both self-money laundering and third-party money laundering offenses. These updates are expected to tighten the prosecutorial approach, ensuring that cases are built on a robust understanding of key evidence requirements. Read more...

_________________________________

Court Orders Forfeiture of Former First Lady’s 15 Luxury Properties

By National Prosecution Authority of Zambia | 27 September 2024

In furtherance of Zambia’s asset recovery efforts, the Economic and Financial Crimes Court has ordered the forfeiture of 15 luxury flats valued at ZMW 66 million belonging to former First Lady, Esther Nyawa Lungu, declaring them proceeds of crime. The judgment marks a key moment in the country’s ongoing fight against financial misconduct.

Delivered today, the court ruled that the former first lady failed to provide sufficient evidence proving that the properties were acquired through legitimate means. Her assertion that her husband, former President Edgar Lungu, had financed the construction of the flats was dismissed due to the absence of supporting documentation. Read more...

_________________________________

Mozambique: Privinvest seeks appeal against London court ruling of $2B damages

By Editor | 19 Septemebr 2024 | Club of Mozambique

By Editor | 19 Septemebr 2024 | Club of MozambiqueLebanese shipping group Privinvest on Wednesday asked to be allowed to appeal against the decision of the London Commercial Court that obliges the shipping group to pay around US$2 billion (€1.8 billion) in compensation to the Mozambican state.

At a hearing being held in the Commercial Division of the High Court in London, Privinvest’s lawyer, Duncan Matthews, asked for the execution of the payment to be suspended so that an appeal could be heard.

The lawyer invoked, among other reasons, Mozambique’s failure to disclose important official documents, so that “a fair trial was not possible”.

Privinvest also said that it does not have enough funds to pay the stipulated amount and warned that if this suspension is not accepted, it will have to go into insolvency. Read more...

_________________________________

Mozambique: PGR calls for multisectoral cooperation to fight organized crime

By Editor |16 September 2024 | Club of Mozambique

By Editor |16 September 2024 | Club of MozambiqueThe assistant attorney general and head of the specialized criminal department within the Mozambican Attorney General’s Office (PGR), Amabélia Chuquela, has called for multisector cooperation in fighting against money laundering, drug trafficking and the kidnappings that have been plaguing the country’s major cities.

According to Chuquela, who was speaking to reporters on Saturday, in Maputo, during activities marking the 35th anniversary of the foundation of the PGR, the investigation of specific crimes faced nowadays by the country demands multisector cooperation. Read more...

_________________________________

EACC hands over corruptly acquired assets worth Sh5 billion

By Allan Kisia | 11 September 2024 |The Star Kenya

The Ethics and Anti-Corruption Commission (EACC) has handed over to the government recovered assets valued at Sh5 billion that were corruptly acquired.The Ethics and Anti-Corruption Commission (EACC) has handed over to the government recovered assets valued at Sh5 billion that were corruptly acquired.

EACC chief executive officer Twalib Mbarak handed over 35 title deeds measuring approximately 18.71 acres at a ceremony held at State House Nairobi on Wednesday. Read More...

_________________________________

10 September 2024 | National Prosecution Authority of Zambia

10 September 2024 | National Prosecution Authority of ZambiaIn a significant development in Zambia’s battle against financial crime, the State has successfully secured the forfeiture of ZMW 58 million in Gold, $200,000 in cash and a Toyota Prado from two Chinese nationals convicted of conveying property suspected to have been stolen. This significant action highlights the power of forfeiture in dismantling the financial networks that sustain criminal activities. Read More...

__________________________________

By Muhamadi Byemboijana |9 Sepember 2024 | Soft Power NewsThe Inspectorate of Government has revealed that it recovered UGX 14B from the orders issued for recovery in Financial Year 2023/2024.

The IG noted that a cash payment of UGX 6B was deposited into the IG asset recovery account and property worth UGX 8.7B was handed over to the institution in lieu of cash.

In the same financial year (2023/2024,) the IG received 2377 complaints concerning corruption, Ombudsman and Leadership Code of Conduct.

Of the 2377 complaints, 1260 were registered from the Head Office while 1117 were registered across the 16 IG Regional Offices. Read More...

__________________________________

South Africa’s Justice Minister Scrutinized Over VBS Loan Controversy

By Oliver Meth |Organized Crime and Corruption Reporting project |29 August 2024

Simelane is accused of receiving a 575,600 South African rand (US$32,258) loan in 2016 from Gundo Wealth Solutions—a company involved in brokering unlawful investments into the now-defunct VBS Mutual Bank—while serving as mayor of Polokwane Municipality in Limpopo province from 2014 to 2021. She allegedly used the loan to buy a coffee shop in Sandton, South Africa’s upmarket economic hub. Gundo Wealth Solutions, owned by Ralliom Razwinane, is directly connected to the illegal investments of municipal funds into VBS Mutual Bank, for which Razwinane is currently on trial for fraud, corruption, and money laundering as a commission agent linking municipalities, including Polokwane, to the now-defunct bank. Read More...